Contemplate, a cash-aside refinance expands your own home loan balance, and you may failure and work out fast costs you can expect to place your household within threat of property foreclosure. It is required to possess a substantial economic plan in position and you can meticulously consider carefully your capability to pay back the loan prior to seeking an effective cash-away re-finance for your swimming pool mortgage.

With regards to resource a pool, an alternative choice to consider is a property equity line of credit (HELOC). A good HELOC enables you to borrow secured on the brand new security of your property, that provides a line of credit that can be used for your share investment. This is what you must know:

A home collateral line of credit functions such as for instance a charge card, the place you get access to a fixed quantity of fund that you could potentially acquire as needed. You pay notice into number you withdraw, making it a flexible selection for financial support the share.

HELOCs have a tendency to have variable personal loan Spokane bank rates, which means that your money may change over the years. However, specific loan providers can offer the option to alter the varying speed on a predetermined rate to own a specific months, getting a whole lot more balances in your monthly payments.

It is important to observe that good HELOC need good credit and you can enough security of your property. Credit unions an internet-based lenders are common offer to have acquiring an excellent HELOC. However, its important to compare rates of interest and fees out of some other loan providers to be sure you will get the best terminology for the share mortgage.

In advance of investing in a beneficial HELOC, take into account the constant repair expenses associated with getting a pool. Normal maintenance and you will correct repair are essential to help keep your pond when you look at the optimal updates, and they costs might be factored in the budget.

Contemplate, a home guarantee credit line places your home on the line while the guarantee. Failing woefully to generate punctual costs you could end up the increased loss of your residence. Its vital to has a stronger financial plan and think about your capability to repay the mortgage ahead of searching for a good HELOC to have your own swimming pool financial support.

Unsecured Personal loans: An option Solution

Without having enough equity in your home or choose not to make use of property once the equity, Stability Pools now offers unsecured signature loans specifically made to have diving pond resource. This type of loans offer self-reliance and benefits towards following professionals:

1. Short and Sleek Processes: Unsecured unsecured loans to possess pond resource typically have a simpler application procedure as compared to traditional domestic security money. This means you can sense a more quickly turnaround big date away from loan software so you’re able to investment.

dos. Amount of Financing Numbers: Regardless if you are trying to loans a tiny more than-ground pond or a large inside the-surface work of art, our unsecured unsecured loans promote mortgage numbers designed for the specific requires. Leave behind sacrifice and hello on swimming pool off your own hopes and dreams.

step three. Zero Security Required: Having an enthusiastic unsecured unsecured loan, you won’t need to make use of your home or any other assets since guarantee. This provides you with assurance and you will liberty, enabling you to attention exclusively toward bringing your ideal pond so you can existence.

Investigating Most other Pond Financing Possibilities

And additionally family guarantee finance and you may unsecured personal loans, there are many more money available options within Integrity Swimming pools and then make your pool goals a real possibility. Why don’t we look closer in the specific other ways from financial support:

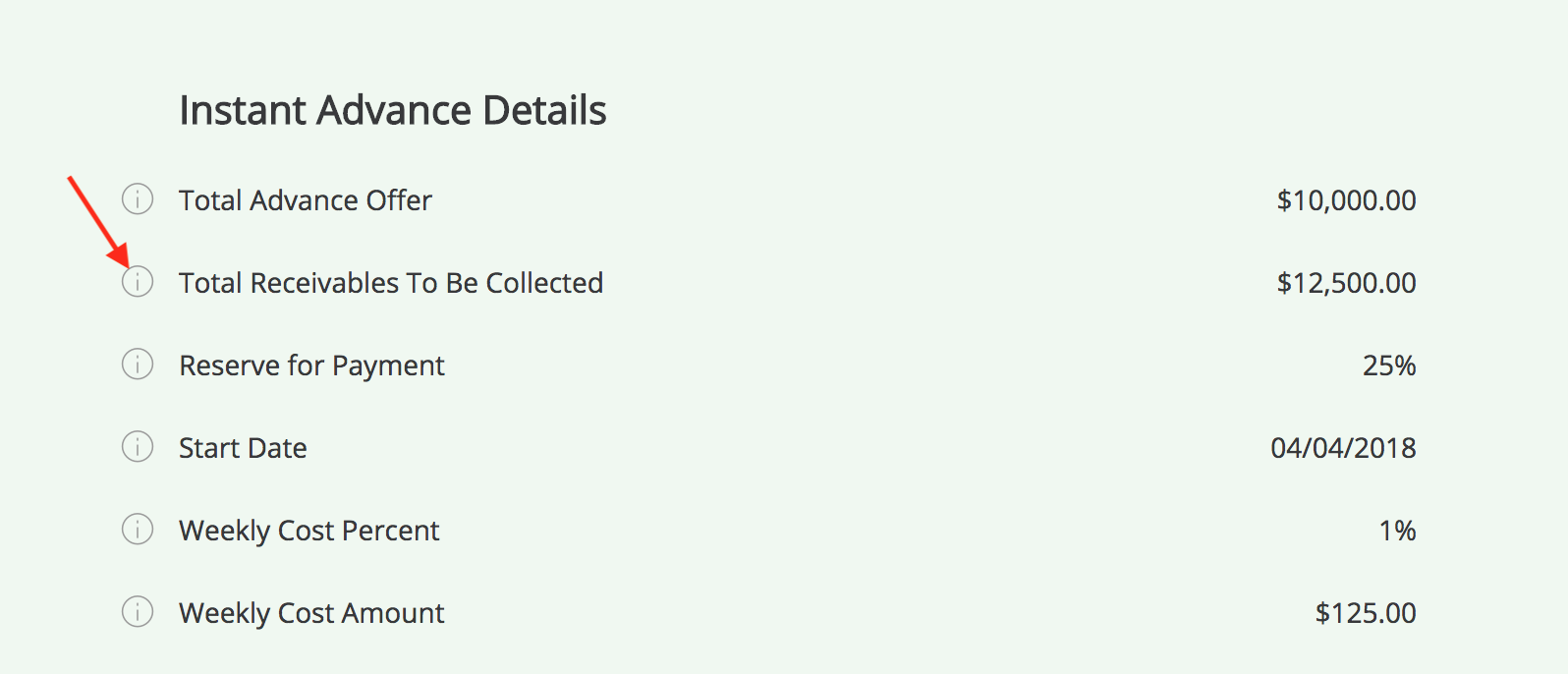

Pond Investment Programs

Ethics Swimming pools even offers pool financing apps specifically geared to users exactly who should dispersed the cost of the share more than big date. This type of applications have a tendency to include aggressive interest rates and versatile cost conditions, enabling you to take control of your monthly premiums comfortably. All of us have a tendency to show you through the app techniques and you can help your in selecting the applying that best suits your needs and you can funds.